[ad_1]

When President Bola Tinubu assumed workplace a yr in the past, the Nigerian financial system was in tatters and seeking a brand new progress path.

One yr later, Tinubu has pushed by way of daring financial reforms which have delivered shock remedy for Nigerians.

The next charts summarise Tinubu’s first yr in workplace:

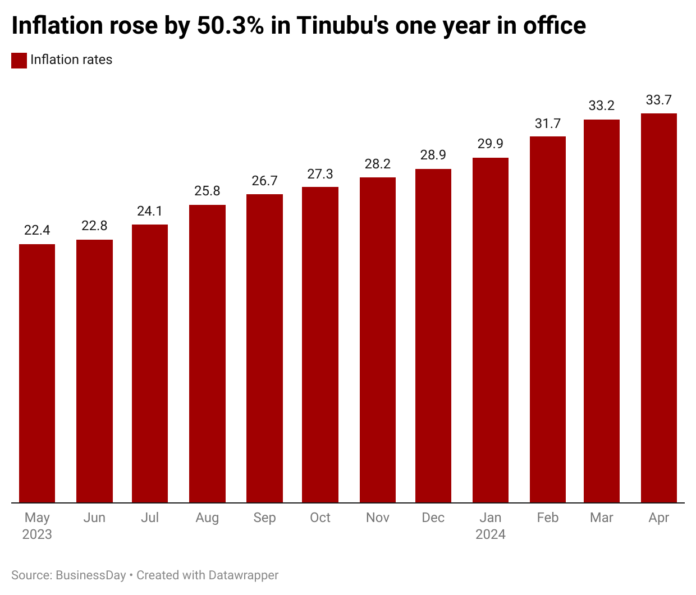

Nigeria’s headline inflation beneath the Tinubu-led administration has spiralled to 33.70 % in April, the very best after a yr of inaugurating successive governments since 1999, BusinessDay’s findings present.

Learn additionally: Nigerians await yields as Tinubu’s daring well being reforms draw $4.8bn

As of Could 2023, when Tinubu took over as president, information from the Nationwide Bureau of Statistics confirmed that the nation’s inflation price was 22.41 %.

Since Tinubu introduced the petrol subsidy removing throughout his inauguration on Could 29, pump costs have greater than tripled, whereas the worth of the naira has plunged following the floating of the foreign money, sparking an explosion of headline inflation.

Analysts challenge that client costs might not ease quickly owing to low productiveness within the agricultural sector, trade price fluctuations, and the threefold enhance in electrical energy tariffs for Band A customers, BusinessDay earlier reported.

Tajudeen Ibrahim, director of analysis and technique at Chapel Hill Denham, stated inflation is predicted to average, including that its deceleration might not sharply contact the 21 % forecast by the nation’s apex financial institution.

The typical value of making ready a pot of jollof rice for a Nigerian household of 5 additionally rose by 55 % to N16,955 from N10,882 inside a yr, largely on account of the naira depreciation, in response to the SBM Intelligence Jollof index.

This equals 53 % of the N30,000 minimal wage, that means {that a} minimum-wage earner can solely prepare dinner jollof rice as soon as a month.

“The price of cooking a pot of jollof rice for me and my household would have value me about N7,000 final yr, however now, even N12,000 can’t sufficiently prepare dinner an identical quantity for my household. I solely prepare dinner jollof rice throughout celebrations; different occasions, I take advantage of floor pepper and eggs,” Lola Adio, a mom of 5 kids, advised BusinessDay.

The report, titled ‘Disaster on the Desk’, by SBM Intelligence, an Africa-focused geopolitical analysis and strategic communications consulting agency, stated that the first set off for the rise was the naira depreciation, which moved from a month-to-month common of N460 to a greenback in Could 2023 to a month-to-month common of over N1,400 in Could 2024.

Learn additionally: 4416 individuals killed, 4334 kidnapped beneath Tinubu administration- Group

“This severely affected meals affordability, notably because the nation nonetheless largely is dependent upon meals imports to satisfy its meals calls for,” the report stated.

NBS information additionally exhibits that Nigerians spent N982 on a nutritious diet in March, costing 95 % greater than N503 after one yr of the Tinubu-led administration.

The CoHD metric assesses the supply, worth, and dietary composition of retail meals objects to determine essentially the most cost-effective mixture assembly the necessities for a nutritious diet.

“Animal supply meals had been the most costly meals group suggestion to satisfy in March, accounting for 37 % of the whole CoHD and offering 13 % of the whole energy,” the report stated.

Throughout his inauguration speech in Could 2023, President Bola Tinubu introduced the removing of the petrol subsidy, which instantly spiked the costs of petrol, meals objects, and companies. Earlier than this, there was a distinction of near N202 for each litre of PMS imported into the nation.

Knowledge gleaned from the NBS exhibits that the typical retail worth paid by shoppers for petrol in April 2024 was N701.24, a 176.02 % enhance when in comparison with the worth recorded in April 2023, earlier than President Tinubu’s assumption of workplace, which was N254.06.

BusinessDay, nevertheless, reported in February that the gasoline subsidy is again in impact and is now higher than what was being paid earlier than Tinubu’s determination to finish the follow in Could of final yr.

Evaluation revealed that the nation is spending round N907.5 billion month-to-month on subsidies for gasoline attributable to a international trade disaster that has pushed the precise value per litre to N1,203.

Learn additionally: Tinubu to unveil emergency blueprint to revamp financial system Edun

Every week earlier than the 2023 presidential election, Mele Kyari, the group chief government workplace of the Nigerian Nationwide Petroleum Firm (NNPC), acknowledged in the course of the closing cutover ceremony of a state-owned oil agency from an organization to an organization in Abuja that the nation is spending over N400 billion month-to-month on petrol subsidies.

Though the federal government nonetheless pays subsidies, the worth of gasoline has continued to extend previously yr, with solely a slight lower in September 2023 and January 2024.

Compounding the steep costs of gasoline was the gasoline shortage, which hit the nation laborious on the finish of April.

“This equals 53 % of the N30,000 minimal wage, that means {that a} minimum-wage earner can solely prepare dinner jollof rice as soon as a month.”

Regardless of assurance from the NNPC that the logistics problem, which had been the reason for the shortage, was resolved, lengthy queues at petrol stations carried on for months. The shortage of petrol heightened the already present difficulties of Nigerians, as staff needed to stand at bus stops for hours to get buses with exorbitant fares, and enterprise house owners needed to face losses of their companies.

Since Tinubu assumed workplace, BusinessDay has reported a sequence of petrol shortages brought on by numerous points.

Likewise, Nigeria’s day by day common crude oil manufacturing is but to surpass the crude oil manufacturing quota handed all the way down to it by the Organisation of Petroleum Exporting International locations (OPEC).

In December, in the course of the thirty sixth ministerial assembly of OPEC and non-OPEC producers, the group forecasted that Nigeria may attain an oil manufacturing quota of 1.5 million barrels per day (mbpd) in 2024.

This projection adopted per week of intense negotiations, leading to an settlement to extend Nigeria’s manufacturing quota for the following yr from 1.38 mbpd to 1.5 mbpd by the oil cartel.

The Nigerian Upstream Petroleum Regulatory Fee’s (NUPRC) newest oil manufacturing standing report revealed that crude oil manufacturing rose by 4 %, at 1.28 mbpd.

Nonetheless, oil manufacturing nonetheless failed to satisfy OPEC’s quota and the manufacturing goal set by the federal authorities.

Within the 2024 price range, the federal authorities established a day by day oil manufacturing goal of 1.78 mbpd to satisfy income targets. The price range set the benchmark worth of crude oil at $77.96 per barrel.

In response to the price range, Mele Kyari, the group chief government officer of the Nigerian Nationwide Petroleum Firm (NNPC), assured that Nigeria would obtain 1.785 mbpd in 2024.

He advised the Senate Committee on Finance that the projections on crude oil manufacturing and the worth benchmark for the 2024 price range had been life like and realisable.

In comparison with the manufacturing determine of 1,335,098 barrels per day (bpd) in December 2023, oil output elevated by 91,476 bpd to achieve 1,426,574 bpd in January 2024.

Nonetheless, for the reason that vital enhance in January, crude oil manufacturing has continued to plunge decrease in consecutive months, leaving consultants to query whether or not the proposed goal could be met earlier than the yr runs out.

Wole Ogunsanya, the chairman of the Petroleum Know-how Affiliation of Nigeria, not too long ago acknowledged that the nation was shedding a big amount of cash day by day on account of its incapacity to deal with declining oil manufacturing.

Ogunsanya asserted that Nigeria would have a higher probability of rating among the many high 20 economies on the earth if it may maintain onto between 60 and 70 % of the oil and fuel worth chain domestically.

The Trans Niger Pipeline issues and a few oil corporations’ nationwide upkeep programmes, in response to the Federal Authorities, are responsible for Nigeria’s decline in crude oil manufacturing.

The federal authorities, nevertheless, added that work was on to restore the pipeline, which might enable the nation to supply as much as 1.7 million barrels of crude oil and condensates per day.

When the present administration commenced operation, credit score to the federal government declined by 37.27 % from N31.23 million in June 2023 to N27.6 trillion the next month.

It continued to say no till it dropped to a document low of N9.4 trillion in October 2023 from N31.23 trillion in June 2023 when the federal government securitized the N22 trillion Methods and Means debt.

The Federal Authorities securitized N22.7 trillion of its overdrafts, often called Methods and Means debt, six months in the past.

In December 2023, the Nationwide Meeting endorsed the securitization of the remaining debit stability of N7.3 trillion from the Methods and Means Advance, channelling it into the Consolidated Income Fund (CRF) of the Federal Authorities.

In February 2024, Cardoso, governor of the CBN, introduced that the apex financial institution would stop offering Methods and Means advances to the federal authorities till the excellent stability is resolved.

Methods and Means is a mortgage mechanism enabling the Central Financial institution of Nigeria to cowl the federal authorities’s price range deficits.

Credit score to the federal government dipped to a one-year low within the first quarter of 2024; it declined by 28.8 % to N19.59 trillion in March 2024, down from N27.53 trillion recorded within the corresponding interval of March 2023.

The continued decline in international foreign money reserves final yr was brought on by low income from crude oil gross sales and elevated demand for international trade (FX), amongst different components. The FX reserves have declined by 6.8 % in a single yr.

Nigeria’s financial system closely depends on oil exports, however oil income has been declining attributable to numerous components. Geopolitical occasions and market circumstances may cause oil costs to fluctuate, impacting Nigeria’s income.

Along with demand stress from the CBN’s interventions on the international trade market, a secondary issue liable for the marked lower in coupon funds on Nigeria’s Eurobonds totaled roughly $149 million in the course of the month.

Beneath this administration, the federal authorities’s borrowing by way of FGN bonds has been between N200 and N700 billion till February this yr, when the DMO put up a N2.5 trillion bond public sale.

The federal authorities offered $1.49 trillion in that public sale; this transfer was an try to front-load its borrowing for the primary half of the yr. It has since gone again to the established order of issuing N300–N600 billion value of bonds.

The naira has been in a race to the underside within the official international trade market for the reason that CBN allowed the official price to weaken in June.

The naira has tumbled by 191 % on the Nigerian Autonomous International Alternate Market (NAFEM), often known as the official market.

The CBN has hiked rates of interest by a complete of 750 foundation factors, bringing the financial coverage price to a complete of 26.25 % in a bid to stabilise the naira and curb inflation.

Nonetheless, analysts have stated that the fiscal authorities should assume self-discipline to extend productiveness and curb inflation.

“The speed hike has a signalling impact on the fiscal authorities. It’s now left to the fiscal aspect to answer these indicators. They should enhance fiscal self-discipline and prioritise spending to enhance progress. I believe that actual GDP won’t get to three.3 %,” Joseph Nnanna, Chief Economist, Improvement Financial institution of Nigeria, stated.

[ad_2]