[ad_1]

The Central Financial institution of Nigeria (CBN) has lately lifted the restriction imposed on some fintech corporations, together with OPay, Kuda, Palmpay and Moniepoint, permitting them to renew onboarding new clients. This choice marks a big shift in Nigeria’s digital banking regulatory panorama.

This order comes after the expiration of a Might 31 deadline given to the fintech corporations to satisfy particular compliance necessities. Here’s a little bit of background.

On April 29, 2024, the CBN issued a directive mandating fintech corporations to halt the onboarding of latest clients. This choice was a response to safety considerations following the identification of 1,146 accounts engaged in peer-to-peer (P2P) cryptocurrency buying and selling.

The first intention was to curb actions that might doubtlessly compromise the integrity of the monetary system. The affected fintech corporations together with notable names like OPay, Moniepoint, Palmpay and Kuda, confronted important operational disruptions as they scrambled to satisfy the brand new regulatory necessities.

You will need to word that some fintech corporations disputed the declare that almost all of implicated accounts belonged to their platforms.

The CBN’s crackdown was rooted in broader safety and compliance points, exacerbated by the rise of cryptocurrency transactions that always function exterior conventional regulatory frameworks.

The involvement of the nation’s Nationwide Safety Adviser (NSA) underscored the gravity of the scenario, as cryptocurrency was labeled as a safety concern. This led to an intensified give attention to Know Your Buyer (KYC) protocols and fraud prevention measures, which have been deemed important to mitigate dangers related to digital monetary transactions.

CBN’s necessities for lifting the ban

For the CBN to raise the restrictions on onboarding new clients, fintech corporations should meet a number of stringent situations to reinforce safety and compliance.

These necessities embrace:

- Bodily handle verification: All tiers of buyer accounts now require bodily handle verification to make sure the legitimacy of account holders. This measure is meant to forestall fraudulent actions and enhance buyer information accuracy.

- Prohibition of P2P cryptocurrency transactions: Fintech corporations have been mandated to dam P2P cryptocurrency transfers to curb the dangers related to cryptocurrency buying and selling. This step is essential to addressing cash laundering and illicit monetary flows.

- Enhanced buyer facial verification techniques: Fintechs have been additionally required to improve their facial verification techniques. This expertise is important for confirming the id of customers and stopping unauthorised entry to accounts.

These measures have been designed to align fintech operations with the regulatory requirements anticipated by the CBN, thereby fortifying the monetary system towards potential threats.

The way it was earlier than the ban

Earlier than the ban imposed by the Central Financial institution of Nigeria (CBN), registering on fintech platforms like OPay and Palmpay was comparatively easy and user-friendly. The method sometimes concerned a number of key steps designed to make sure ease of entry whereas sustaining fundamental safety protocols.

Right here’s a basic overview of how straightforward it was to register:

- Obtain the App:

- Create an Account: The registration course of often requires fundamental info equivalent to identify, telephone quantity, and electronic mail handle.

- Verification: Primary KYC (Know Your Buyer) checks have been carried out, which could embrace verifying the telephone quantity by way of an OTP (One-Time Password).

- Linking financial institution accounts: Customers had the choice to hyperlink their financial institution accounts or playing cards for seamless transactions.

- Minimal documentation: For lower-tier accounts, the documentation necessities have been minimal, typically not extending past a nationwide ID or BVN (Financial institution Verification Quantity).

The method was designed to be fast, typically taking just some minutes to finish. However, whereas the registration course of was straightforward, fintech platforms had applied fundamental safety measures to adjust to regulatory requirements:

– KYC procedures: Even earlier than the ban, fintechs adhered to fundamental KYC protocols to confirm the id of customers.

– Fraud prevention: Primary mechanisms have been in place to detect and forestall fraudulent actions.

Reactions from the affected fintech corporations

A few of the main gamers within the fintech group have responded nicely to the CBN’s choice to raise the restrictions, emphasising their dedication to compliance and buyer safety.

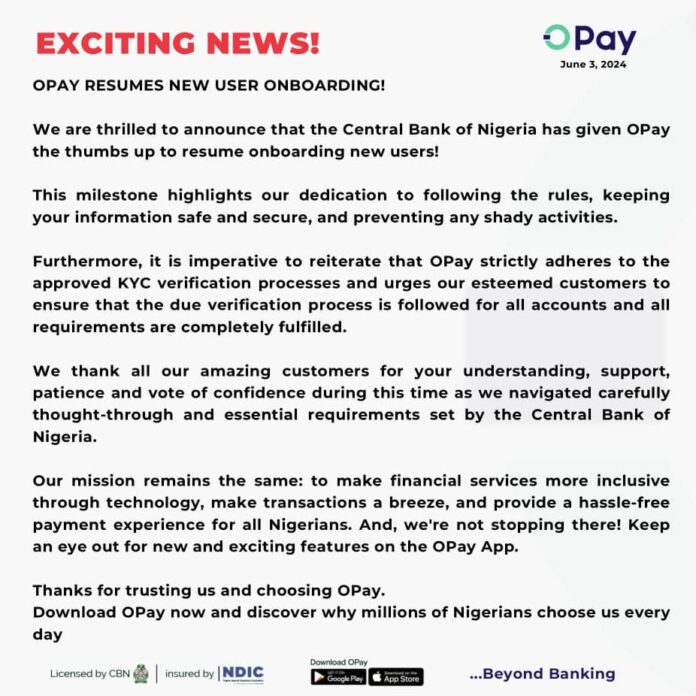

As an example, OPay took to its social media deal with to precise its pleasure and reaffirm its dedication to adhering to the brand new regulatory necessities. OPay’s message to its clients highlighted its rigorous KYC verification processes and the significance of account verification.

Equally, Kuda, one other affected fintech firm, introduced the resumption of latest buyer sign-ups. In a press release shared on X, Kuda acknowledged the collaborative efforts with the CBN to implement mandatory account controls and guarantee regulatory compliance.

The corporate emphasised the necessity for patrons to supply their Financial institution Verification Quantity (BVN), Nationwide Identification Quantity (NIN), and proof of handle for opening Tier 3 accounts, indicating a sturdy verification course of.

Palmpay wrote on X, “After regulatory overview, we’re again and able to welcome you with open arms.”

Why this issues

“Regulation could be very vital in a sector that appears to have grown so extremely quickly,” CBN governor, Olayemi Cardoso emphasised through the 295th Financial Coverage Committee assembly.

The choice by the CBN to raise the onboarding restrictions on fintech corporations is essential for a number of causes.

First, it signifies a renewed belief within the fintech sector’s skill to adjust to regulatory requirements. By assembly the stringent necessities set by the CBN, these corporations have demonstrated their dedication to sustaining excessive ranges of safety and transparency.

Second, this transfer is important for the expansion and improvement of the fintech business in Nigeria. Fintech corporations play a pivotal position in driving monetary inclusion, providing modern options that cater to the unbanked and underbanked populations.

Moreover, CBN’s choice underscores the significance of regulatory oversight within the quickly evolving fintech panorama.

As highlighted by Cardoso, the measures put in place intention to curb cash laundering and illicit monetary flows, making certain that the fintech sector operates inside a sturdy regulatory framework. This enhanced regulatory setting is predicted to construct buyer belief and confidence, which is important for the long-term sustainability of digital monetary companies.

Future implications

Trying forward, the lifting of the onboarding restrictions is more likely to have a number of constructive implications for the fintech sector in Nigeria.

Firstly, fintech corporations can now give attention to increasing their buyer base, driving innovation, and enhancing their service choices. This progress is predicted to contribute to elevated competitors throughout the monetary companies business, finally benefiting shoppers by way of higher services.

Additionally, the strengthened regulatory framework will function a basis for future developments within the fintech area. With heightened surveillance and compliance measures in place, the sector is healthier geared up to forestall fraud and different illicit actions, just like the one with Nigerian actress, Shan George who shared a video on her Instagram account interesting for assist to recuperate her cash, saying, “Cecilia Chiagoziem Okoro that’s the identify of the person who have simply wiped all the cash in my account, 3.6 million [naira] into an Opay account.”

The brand new KYC necessities not solely defend shoppers but additionally improve the general stability and integrity of the monetary system.

The collaboration between the CBN and fintech corporations units a precedent for constructive engagement between regulators and business gamers. This assumed cooperative strategy is important for addressing rising challenges and alternatives within the fintech sector, making certain that regulatory insurance policies preserve tempo with technological developments.

[ad_2]