[ad_1]

The South African Reserve Financial institution (SARB) is anticipated to carry its financial coverage committee assembly on Thursday, the place it should both minimize charges or maintain them regular as inflation has slowed for the second month in a row.

In the meantime, Nigeria’s naira is tipped to start moderating following the latest third charge hike by a complete of 750 foundation factors to 26.25 p.c by the Olayemi Cardoso-led central financial institution.

Monday, twenty seventh Could, 2024

NBS to launch Labour Drive Report

The Nationwide Bureau of Statistics will launch a report on the Nigerian labour drive for Q1 2024 on Monday.

The labour drive participation charge measures the share of a rustic’s working-age inhabitants that’s within the labour drive.

Learn additionally: CBN bans avenue buying and selling as naira falls below contemporary stress

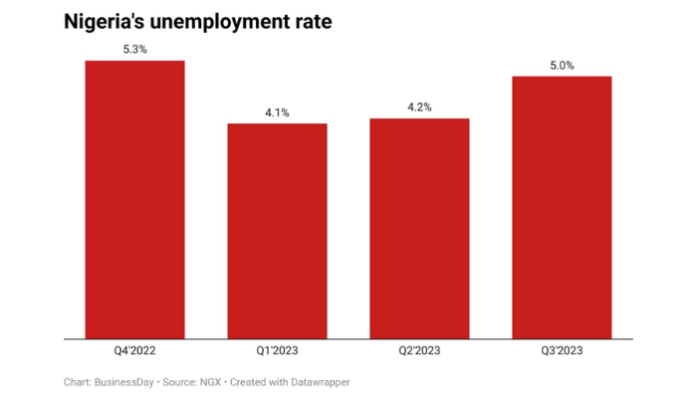

Within the third quarter of 2023, the Nigeria Labour Drive Survey confirmed that the unemployment charge rose to five.0 p.c from 4.2 p.c within the earlier quarter.

It stood at 4.1 p.c within the first three months of 2023, down from 5.3 p.c in This fall of 2022.

The share of self-employed Nigerians declined to 87.3 p.c within the third quarter of 2023 from 88.0 p.c within the earlier quarter. Wage employment rose to 12.7 p.c from 12.0 p.c.

“Casual employment in Nigeria and different growing international locations appears to be very excessive when in comparison with developed international locations. The share of employed individuals in casual employment was 92.3 p.c in Q3, a discount of 0.4 p.c when in comparison with 92.7 p.c within the earlier quarter,” the report mentioned.

Specialists say the decline in self-employment in Nigeria, also referred to as a ‘hustle financial system’, exhibits that companies are shutting down, thereby threatening the nation’s entrepreneurship progress and improvement.

“The discount in self-employment is a sign that extra companies are happening, significantly the micro and nano ones, that are run as self-employment because of harsh financial realities,” Femi Egbesola, nationwide president of the Affiliation of Small Enterprise House owners of Nigeria, mentioned.

“Specialists say the decline in self-employment in Nigeria, also referred to as a ‘hustle financial system’, exhibits that companies are shutting down, thereby threatening the nation’s entrepreneurship progress and improvement.”

Wednesday, Could 29, 2024

NBS to launch Firm Earnings Tax Report, Q1 2024

The Nationwide Bureau of Statistics will launch the Firm Earnings Tax (CIT) knowledge for the primary quarter of 2024 on Wednesday.

CIT, also referred to as company tax, declined by 35.40 p.c within the fourth quarter of 2023, NBS knowledge exhibits.

Company tax for the fourth quarter of 2023 stood at N1.13 trillion, up from N1.75 trillion within the third quarter.

CIT, one of many authorities’s income sources, is a tax on the earnings of registered native and overseas corporations working in Nigeria.

Since President Bola Tinubu introduced the removing of the petrol subsidy, pump costs have greater than tripled, whereas the worth of the naira has plunged following the floating of the forex, sparking a decline within the backside traces of corporations working in Nigeria.

Learn additionally: Naira closes flat as greenback provide surges two-months excessive of $556.25m

Regardless of overseas trade (FX) challenges, the manufacturing sector was the main contributor to CIT final 12 months, recording N626.4 billion, indicating a 34 p.c enhance from N468.6 billion collected in 2022.

Analysts count on the CIT to fall barely within the first quarter on the again of the weak naira and excessive vitality prices.

Thursday, Could 30, 2024

South Africa Reserve Financial institution to carry charge choice

The South African Reserve Financial institution (SARB) will maintain charge selections on Thursday.

The nation’s financial coverage committee is anticipated to carry its benchmark rate of interest at 8.25 p.c on Could 30, the day after the nation’s basic election, earlier than doubtless starting an easing cycle subsequent quarter as inflation cools.

Whereas some economists imagine charges shall be minimize by 25 foundation factors to eight p.c both in July or September, others count on no change within the subsequent quarter.

A studying that’s stronger than forecast is mostly supportive (bullish) for the ZAR, whereas a weaker than forecast studying is mostly destructive (bearish) for the ZAR.

Based on a ballot by Reuters, inflation in South Africa is anticipated to common 5.1 p.c this 12 months after which sit in the midst of the goal vary at 4.5 p.c for the subsequent two years.

Whereas the central banks of different nations are mountaineering lending charges to tame stubbornly excessive inflation, shopper costs in Africa’s largest financial system, South Africa, eased to an annual 5.2 p.c in April from 5.3 p.c in March.

Friday, Could 31, 2024

NBS to launch chosen banking sector knowledge for Q1 2024

The Nationwide Bureau of Statistics will launch the chosen banking sector knowledge for the primary quarter of 2024 on Friday.

The report outlines the sectoral breakdown of credit score allotted to the non-public sector, the quantity of e-payment transactions, and employees power within the banking sector. The final report revealed on chosen banking sector knowledge was for the 12 months 2021.

Complete non-public sector credit score allocation in 2021 totaled N267.11 trillion, with the oil and fuel, manufacturing, and basic providers sectors recording the best allocations, NBS knowledge exhibits.

Analysts count on non-public sector credit score allocation to contract off the again of CBN’s hiked rate of interest of 26.25 p.c.

Learn additionally: Nigerians shift to domestically used automobiles as costs soar on risky naira

Naira set to reasonable as CBN hikes charge once more

The naira is anticipated to reasonable at N1,400 per US greenback because the Central Financial institution of Nigeria continues its aggressive financial tightening.

Nigeria’s naira has plummeted towards the greenback by over 100% in a 12 months, flipping from the top-performing forex to the worst.

In its 295th MPC assembly, the central financial institution hiked the nation’s benchmark rate of interest by 150 foundation factors to 26.25 p.c, making it the third straight time it should enhance lending charges.

As of final Thursday, the naira depreciated to N1,485.66/$ within the official market whereas it fell to N1,515/$ on the road.

Many analysts imagine that the hawkish stance will help the bruised naira and tame the stubbornly excessive inflation whereas projecting the naira to hover round N1400/$ on the official window and N1,500/$ on the parallel market.

If the naira moderates, imported items might change into cheaper because the buying energy of the naira will increase. This will result in decrease costs for merchandise that Nigeria imports too.

It additionally implies that buyers will discover the Nigerian forex extra enticing because of the larger returns on investments. This will result in elevated overseas funding, decrease inflationary pressures, and doubtlessly stronger financial progress, benefiting shoppers and companies alike, mentioned a monetary market analyst.

[ad_2]